5 Innovative Trends Shaping the Future of the Debt Collection Agencies Industry

The debt collection industry, as we know it, finds itself at the precipice of a transformative era. In this dynamic landscape, various innovative trends are rapidly gaining momentum, shaping and redesigning the future of debt collection agencies. This article aims to delve into an exploration of five key trends that are revolutionizing this industry, dissecting their characteristics, implications, and the pivotal role they are poised to play in the future.

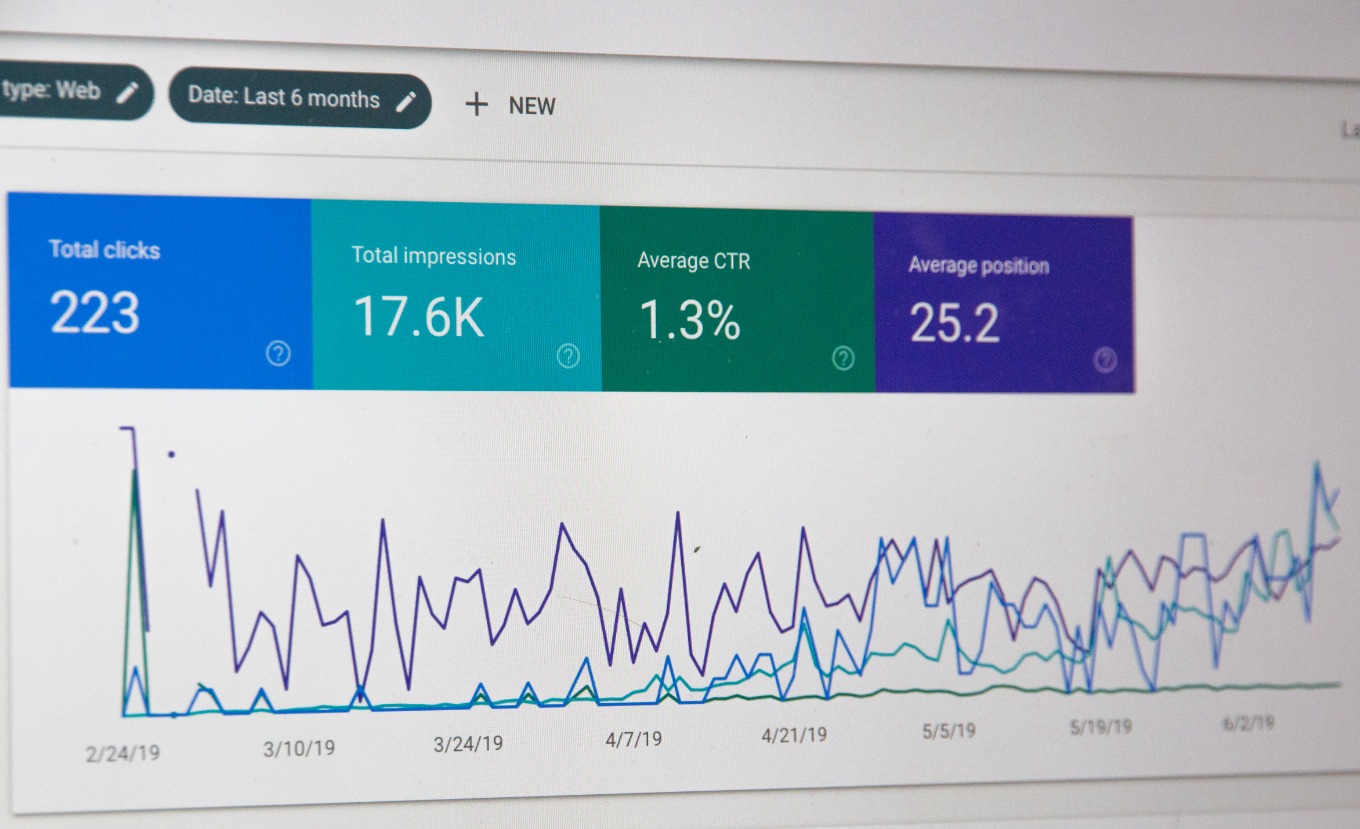

The first trend revolves around the implementation of Advanced Analytics. In the past, debt collection relied heavily on instinct and experience, but today, agencies are augmenting their decision-making processes with data-driven insights. Advanced analytics entails the utilization of sophisticated algorithms and statistical methods to discern patterns and correlations within large datasets. The significance here lies in the actionable insights that can be derived from these patterns and exploited to enhance collection strategies. For instance, predictive modeling can forecast a debtor's propensity to repay, enabling agencies to prioritize their resources effectively.

However, the introduction of advanced analytics also portends potential challenges. The trade-off between harnessing data's predictive power and maintaining privacy standards is a critical concern. The industry has to navigate the fraught terrain of data ethics and confidentiality, ensuring compliance with regulations like the General Data Protection Regulation (GDPR) while capitalizing on data's potential.

Following closely is the second trend: the adoption of Fintech Solutions. Fintech, a portmanteau of 'financial technology,' refers to the use of technology to streamline and automate financial services and processes. Collection agencies are leveraging fintech solutions to enhance efficiency and customer experience. For instance, agencies are using digital platforms that facilitate online negotiations, allowing debtors to customize their repayment plans autonomously. This self-service approach not only alleviates the pressure on collection staff but also empowers debtors, enhancing their engagement and willingness to repay.

Nevertheless, fintech adoption is not without its trade-offs. The threat of cybercrimes is a poignant reminder of the vulnerability inherent in digital transactions. In parallel, the rapid fintech evolution necessitates consistent technological updates and staff training, adding to operational costs.

The third trend is the increasing reliance on Artificial Intelligence (AI) and Machine Learning (ML). AI refers to computer systems capable of performing tasks that traditionally require human intelligence, while ML is a subset of AI where machines learn from data. Debt collection agencies are employing AI and ML in areas like communication, customer profiling, and even legal compliance. For example, AI chatbots interact with debtors, addressing their queries and negotiating repayments, while ML algorithms analyze debtor profiles, predicting their default risk and personalizing the collection approach.

However, the AI and ML revolution also warrants caution. The black-box nature of certain ML algorithms may result in opaque decision-making processes that contravene ethical and legal norms. Additionally, over-reliance on AI may dehumanize the collection process, jeopardizing the relationship with debtors.

Fourthly, there is a growing shift towards Ethical Debt Collection, emphasizing respect for the debtor's dignity and rights. This includes transparency in communication, sensitivity towards the debtor's circumstances, and strict adherence to legal obligations. The relevance of this trend is twofold. First, it fosters a positive brand image, enhancing the agency's reputation among clients and regulators. Second, it engenders debtor trust and cooperation, improving collection outcomes.

Yet, the quest for ethical collections is not without its dilemmas. Balancing debtor empathy with the imperative to recover funds is an intricate task, requiring careful judgment and discretion.

Finally, the fifth trend is the Regulatory Evolution, characterized by stricter rules and greater scrutiny. With regulators globally tightening their grip, agencies are compelled to refine their processes to ensure compliance. Rigorous regulation indirectly encourages innovation as agencies seek efficient ways to reconcile collection objectives with legal mandates.

However, the ever-changing regulatory landscape poses a paradox. While it safeguards debtor rights and industry integrity, it also imposes conformance pressures on agencies, necessitating constant vigilance and adaptability.

To surmise, these five trends - Advanced Analytics, Fintech Solutions, AI and ML, Ethical Debt Collection, and Regulatory Evolution - are dramatically reshaping the debt collection industry, confronting it with a cocktail of opportunities and challenges. As we navigate through these transformative currents, we realize that the future is not an abstract concept waiting at the distant horizon. Instead, it is being conceptualized and crafted in the crucible of the present, with every decision, every adaptation, and every innovation we embrace.

This article aims to delve into an exploration of five key trends that are revolutionizing the debt collection industry, dissecting their characteristics, implications, and the pivotal role they are poised to play in the future.